The U.S. House of Representatives recently passed a non-binding resolution that a carbon tax would kill jobs, damage the revitalized American economy, and disproportionately impact poor, minority and working class families.

The U.S. House of Representatives recently passed a non-binding resolution that a carbon tax would kill jobs, damage the revitalized American economy, and disproportionately impact poor, minority and working class families.

The vote also reflects the fact that America is still over 80 per cent dependent on fossil fuels – and helps explain why a misguided Republican Carlos Curbelo of Florida was able to convince only one colleague (Republican Brian Fitzpatrick of Pennsylvania) to co-sponsor his carbon tax bill back in July.

In the meantime, Doug Ford became Ontario’s new premier in part by vigorously opposing the carbon taxes, and pricy wind and solar electricity that many Canadians have come to despise. He quickly eliminated $2 billion in taxes a year by cancelling 200 heavily subsidized renewable energy projects implemented by his predecessor.

Meanwhile, the Trudeau government faces increased resistance to its plans for a steadily escalating carbon tax.

In Australia, Angus Taylor’s appointment as Energy minister means wind and solar subsidies will soon be terminated. This will undoubtedly delight residents of South Australia, home of a 50 per cent renewable energy program, the world’s highest electricity prices, two weeks of zero wind/zero electricity in two years, and some 200,000 families no longer able to afford electricity.

Germany’s solar industry is collapsing as its subsidies plummet; its wind turbine subsidies are scheduled to end in 2020; ancient villages and forests have been bulldozed to allow coal mining to fuel its new generating plants; and the country’s Green Party has admitted that “de-carbonizing” the German and world economies can be accomplished only by limiting or eliminating democracy worldwide.

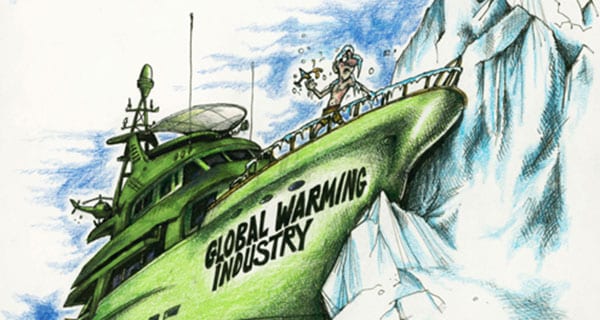

And yet, like Dracula monsters, carbon tax proposals keep rising from the dead.

Several big corporations, U.S. Republican officials Jim Baker, Hank Paulson and George Schultz, and their Climate Leadership Council now claim that 56 per cent of American voters support taxing carbon, while only 26% oppose the idea. So says their recent survey. How is that possible?

To begin with, they didn’t call it a tax. They cleverly labelled their scheme a “carbon dividend” (who doesn’t like dividends?) and claimed “the vast majority of American families” would somehow come out ahead if it’s implemented. The survey didn’t mention that their program would be administered by the ever-friendly Internal Revenue Service or that the tax would begin at US$43 per tonne of ‘carbon’ emitted. (Trudeau’s hated tax begins at C$10 per tonne and rises to $C50 by 2022.)

They didn’t mention that the tax would be imposed on foundries, factories, refineries, coal- and gas-fired power plants, other industrial facilities, and even (at a lower rate) on products imported from other countries. Nor did they intimate how much these advisers, companies and thousands of members of the $2-trillion-per-year global climate industrial complex would benefit financially from the arrangements.

Equally important, constant assurances that market-based carbon tax schemes like this US$43-per-tonne version would be ‘revenue neutral,’ receipts would be returned to taxpayers in the form of tax reductions elsewhere, and revenues would be used to reduce federal budget deficits are illusory. Can the council somehow guarantee that the next Congress will not (promptly) reverse these net-gain provisions?

But let’s get to the nuts and bolts of carbon taxes and ‘clean, green, renewable’ energy.

As MIT emeritus professor of atmospheric physics Richard Lindzen points out, those who control carbon control life. And make no mistake, these are taxes on carbon-based fuels: on 83 per cent of the energy we use. They are taxes on everything we make, ship, eat and do – on our lives, livelihoods, living standards, transportation, heating, cooling, refrigeration, healthcare, clothing and everything else we touch.

By using the word ‘carbon,’ tax proponents deceptively suggest they want to tax soot, pollution, toxic emissions. But with modern scrubbers and other pollution controls, what comes out of power plant and factory ‘smoke stacks’ today is almost entirely water vapour and carbon dioxide.

Fossil fuels are what made our health and economic progress over the past 150 years possible – and continue to do so. Carbon (coal, oil and natural gas) is what we burn to generate electricity, power factories and operate vehicles. Carbon dioxide is what’s created and emitted by that combustion process.

So these climate leadership members want to tax carbon dioxide: the gas of life, the miracle molecule that we exhale and that makes life on Earth possible. In fact, the more CO2 in the atmosphere, the faster and better food crop, forest and grassland plants grow; the better they survive droughts, diseases and viruses. Rising atmospheric CO2 levels are actually greening the Earth, including forests worldwide.

The council’s goal is to keep fossil fuels in the ground, and force a transition to wind, solar, ethanol and other ‘renewable’ energy. In the process, the activists, politicians, lobbyists and crony corporatists expect to get incredibly wealthy and gain increasing control over global economies and living standards.

How would US$43 per tonne of carbon dioxide affect you? It would raise your electricity and gasoline costs to the exorbitant rates families and businesses already pay in California, Denmark and Germany. Every aspect of your lives would be impacted. Millions of jobs would be lost.

To top it off, all this incredible pain and lost liberty would bring no climate benefits. Even assuming for the sake of argument that carbon dioxide has replaced the sun and other powerful natural forces that do control Earth’s climate – poor nations are burning more carbon fuels every year, emitting more CO2 and other greenhouse gases, and building or planning to build some 1,600 new coal-fired power plants.

It is sheer nonsense to claim that 400 ppm CO2 and another 1 degree C of global warming will bring “unprecedented cataclysms” and “existential threats” to people and planet. Carbon dioxide has some effect, but saying it controls the climate ignores five Pleistocene glacial and interglacial periods, the Roman and Medieval Warm Periods, the Little Ice Age, the Dust Bowl and Anasazi drought, the record 12 years of no major hurricanes making U.S. landfall, and other natural weather and climate changes.

Scientists simply don’t know enough about Earth’s climate or what caused past climate fluctuations even to separate current human influences from natural influences – much less predict future changes.

Poor countries signed onto Paris climate treaty because they expected to get $100 billion every year in “climate adaptation and mitigation” money from currently wealthy countries that the treaty says must slash their fossil fuel use, carbon dioxide emissions, economic growth and living standards – while now-poor nations dramatically increase theirs. With rich countries unable and refusing to pay up, the treaty is likely to implode like the house of cards it is, before or during the COP24 summit in December in Katowice, Poland.

Last but not least, renewable energy is not renewable, clean, green or sustainable. Manufacturing wind turbines, solar panels, backup batteries and ultra-long transmission lines requires removing billions of tonnes of rock and earth to extract and process millions of tonnes of exotic ores, limestone, iron, manganese, copper, petroleum-based fibreglass and composites, and other materials – all using fossil fuels.

The vital exotics come from Mongolia, China and Congo, under minimal to nonexistent environmental, health and safety standards. But that’s somebody else’s backyard, so virtue-preening climate activists can just ignore the emissions, habitat destruction, water pollution, health effects and premature deaths.

No wonder alarmists are ranting nonstop at their global climate action circus, devoting US$1 billion a year to climate activism and ’education’ to advance their radical agenda, draft laws and regulations, and attack and even prosecute climate chaos skeptics. This abuse of government law enforcement powers and taxpayer dollars must end.

What needs to be kept in the ground is not the fossil fuels that make modern health and living standards possible, while spurring plant growth. It’s carbon tax proposals, preferably with large wooden stakes driven through their hearts. May sanity and reality yet prevail.

Frontier Centre for Public Policy contributor Paul Driessen is senior policy analyst for the Committee For A Constructive Tomorrow and author books and articles on energy, climate change, economic development and human rights.

The views, opinions and positions expressed by columnists and contributors are the author’s alone. They do not inherently or expressly reflect the views, opinions and/or positions of our publication.